The Bihar Student Credit Card Scheme 2026 (BSCC) is one of the most powerful education support programs launched by the Government of Bihar to help students pursue higher education without financial pressure. Under this scheme, students can get an education loan of up to Rs. 4 lakh to study in India or abroad. The biggest advantage is that the Bihar government has made this scheme interest-free, making it extremely beneficial for students from middle-class and low-income families. Every year, lakhs of students search for “Bihar Student Credit Card Scheme apply online”, “Bihar Student Credit Card eligibility”, and “Bihar Student Credit Card interest-free” because this scheme can change their future.

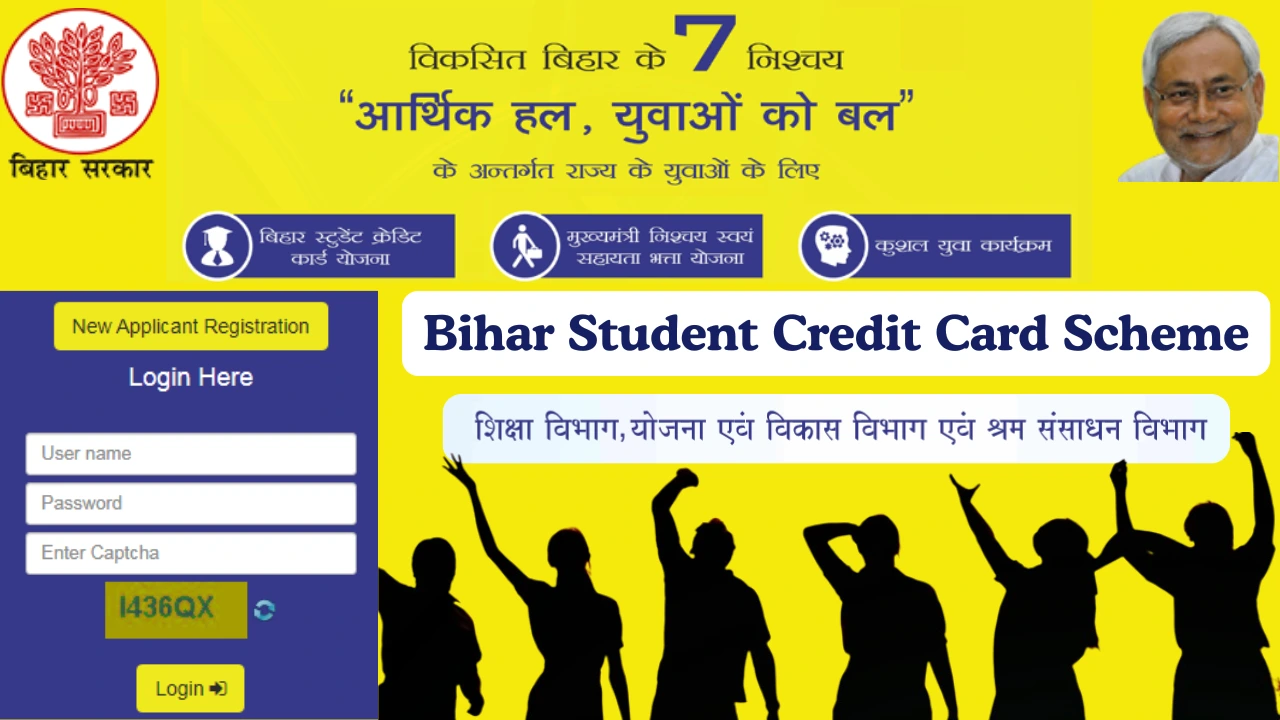

This scheme is part of the Saat Nischay Yojana and is managed through the official portal ccbihar.com. If you are planning to do engineering, medical, management, or any professional course and money is a problem, this scheme can be a life-changing opportunity for you.

What is the Bihar Student Credit Card Scheme?

The Bihar Student Credit Card Scheme is a government education loan scheme specially designed for students who want to pursue higher education after 12th or a diploma but cannot afford high fees. Through this scheme, the Bihar government provides a student credit card (education loan) of up to Rs. 4,00,000. This loan can be used to pay college fees, hostel fees, books, laptop, and other education-related expenses.

Earlier, the scheme had a small interest rate, but now the Bihar government has made the Bihar Student Credit Card Scheme completely interest-free for all students. This means students only have to repay the principal amount. This makes it one of the best government education loan schemes in India.

Objectives of the Bihar Student Credit Card Scheme

The main objective of the Bihar Student Credit Card Scheme 2026 is to ensure that no student in Bihar is forced to stop studying due to lack of money. Many talented students leave their studies after 12th because they cannot afford college or professional courses. This scheme removes that barrier.

Another important goal is to increase the Gross Enrollment Ratio (GER) in higher education in Bihar. By providing easy, interest-free education loans, the government wants more students to join colleges, universities, and technical institutes and build a better future.

Key Features

The Bihar Student Credit Card Scheme has many attractive features that make it better than normal education loans from banks:

- Students can get a loan up to Rs. 4,00,000

- The loan is now interest-free

- No collateral or security is required

- No guarantor is required in most cases

- Repayment starts after course completion

- Long repayment period (up to 10 years)

- A loan can be used for tuition fees, books, laptop, hostel, etc.

Loan Amount, Interest Rate and Repayment Rules

Loan Amount

- Maximum loan: Rs. 4,00,000

- The actual amount depends on your course fee and duration.

Interest Rate

- 0% interest (Interest-Free) – as per the latest Bihar government announcement.

Repayment Period

- If the loan is up to Rs. 2 lakh: up to 7 years

- If the loan is above Rs. 2 lakh: up to 10 years

- Repayment usually starts after course completion and a grace period.

CollegeList for BSCC Scheme

The Bihar Student Credit Card (BSCC) scheme includes many government and private colleges, covering major institutions and helping students access affordable higher education across India without financial pressure.

Eligibility Criteria for BSCC Scheme

To apply for the Bihar Student Credit Card Scheme 2026, the student must:

- Be a permanent resident of Bihar

- Have passed 12th class (or 10th for polytechnic/diploma)

- Have taken admission in a recognised institute or university

- The course should be approved by the government

- Age limit and other conditions as per the latest guidelines

If you fulfil these conditions, you can easily apply online.

Courses Covered Under This Scheme

The Bihar Student Credit Card Scheme covers almost all important higher education courses, such as:

- Engineering (B.Tech, B.E)

- Medical (MBBS, BDS, Nursing, etc.)

- Management (MBA, BBA)

- Law, Pharmacy, Architecture

- B.Sc, B.Com, B.A, and other graduation courses

- Polytechnic and other technical courses

Documents Required for BSCC Scheme

To apply online, you generally need:

- Aadhaar Card

- Residence Certificate of Bihar

- Income Certificate

- Caste Certificate (if applicable)

- 10th and 12th mark sheets

- Admission letter from college/institute

- Bank account details

- Passport-sized photograph

How to Apply Online (Step-By-Step)

Follow these steps to apply:

- Visit the official website: ccBihar.com

- Register yourself with your mobile number and email

- Fill the online application form carefully

- Upload all required documents

- Submit the application

- Visit the DRCC office for document verification

- After approval, the loan amount is sanctioned

Benefits of a Student Credit Card

The biggest benefits are:

- Makes higher education affordable

- No interest burden on students

- No need to mortgage land or property

- Encourages poor and middle-class students to study

- Reduces the dropout rate after 12th grade

- Supports Bihar’s youth in building careers

This scheme is truly a game-changer for education in Bihar.

Challenges and Limitations

Although the scheme is excellent, there are some issues:

- Rs. 4 lakh may not be enough for very expensive courses

- The application process can be slow sometimes

- Many rural students are still not aware of the scheme

- Portal and verification delays are sometimes reported

Still, compared to normal bank loans, this scheme is much better.

Latest Updates on BSCC Scheme 2026

The biggest update is:

- The Bihar government has made the scheme completely interest-free for all students.

FAQs

1. What is the maximum loan amount under the Bihar Student Credit Card Scheme? Up to Rs. 4,00,000.

2. Is the Bihar Student Credit Card Scheme really interest-free? Yes, as per the latest government update, it is 100% interest-free.

3. Who can apply for the Bihar Student Credit Card Scheme? Any permanent resident of Bihar who has passed 12th and taken admission in a recognized course.

4. When does repayment start? After the course is completed and the grace period has passed.

5. What is the official website to apply to? The official website is ccBihar.com.

Conclusion

The Bihar Student Credit Card Scheme 2026 is one of the best education loan schemes in India, especially because it is now interest-free. It gives students from poor and middle-class families a golden chance to complete higher education without financial stress. If you are a student from Bihar and planning for college or professional studies, you should definitely apply for this scheme.

Read More: IGNOU Admission 2026

Leave a Reply to Jyoti Kumari Cancel reply